Consultation on National Financial Inclusion Strategy with Bangladesh development partners

On Thursday 24 May, we met with the country's development partners in Dhaka to discuss their views of the draft National Financial Inclusion Strategy for Bangladesh.

The National Financial Inclusion Strategy for Bangladesh is a public document roadmap to help excluded populations get access to financial services. The Business Finance for the Poor in Bangladesh programme is assisting the Bangladesh Bank to draft the Strategy, which aims to:

Assist Government to adopt a coordinated approach across ministries, public and private sectors

Raise national awareness of the need for greater financial inclusion

Build trust and collaboration among stakeholders

Implement, coordinate and monitor actions

This event gave a platform to international development partners to offer their unique perspectives on the NFIS draft.

At the event, Mr. Asif Iqbal, Deputy Director of Bangladesh Bank, offered a presentation of the draft National Financial Inclusion Strategy. The NFIS development process was discussed in detail, along with the six strategic thrusts that the Strategy will address (see below).

Among the special guests were Mr. Arijit Chowdhury, Additional Secretary, Financial Institutions Division, Ministry of Finance, and Government of the People’s Republic of Bangladesh as the Chief Guest.

Ms. Afsana Islam the Private Sector Adviser, DFID Bangladesh offered closing remarks.

Digitisation was discussed as the Core Pillar of the NFIS-B, to expand inclusion right from the financial to the social services as well. In lieu, the Vision 2021 was stated which aims to develop Bangladesh into a resourceful and modern economy through the efficient use of information and communication technology.

Vision of the NFIS-B

To create an integrated and accessible financial system that responds to the needs of the country's population and enterprises and supports rapid and inclusive development of the country’s real sector.

“We should focus on social cohesion and not just financial inclusion.”

6 STRATEGIC THRUSTS WITHIN NATIONAL FINANCIAL INCLUSION STRATEGY

Expand consumer choice and convenience with broader range of financial instruments

Strengthen interconnections between financial service providers and digital ecosystems

Build common industry infrastructure fit for future

Strengthen customer empowerment and protection

Prioritize women, youth and MSMEs

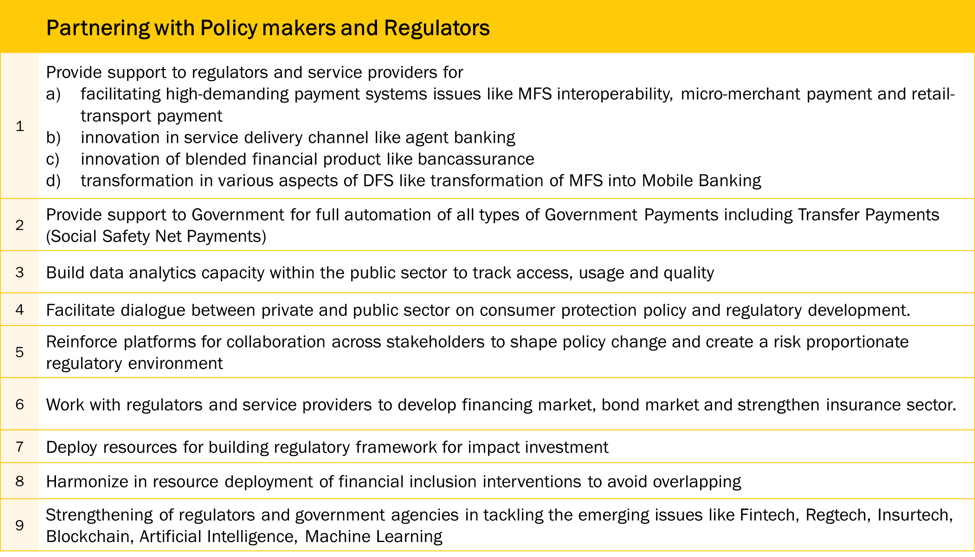

Create enabling core policies and regulations

“Without experimenting the financial products, we cannot develop the products for all.”

Questions raised during the event

Can we reach out to the people who need financial inclusion?

Will the draft NFIS presented be a stand-alone strategy? And what will be the time bound action plans for this strategy?

What will be the impact of technology across the six strategic thrusts?

Will the thrusts constraint or help the development partners to provide support?

What can be done as there is often restriction from the public sector on the innovation of the private sector?

Suggestions and remarks to the questions

Whether it is possible or not to reach out to the people who need financial inclusion the most is one of the areas being studied. Final conclusions will be sent to the cabinet division.

Regulations are present that will address funding of the wide range of financial products.

In order to bring the public and private sectors together on mutual ground, regulator intervention is required.

LET'S CONNECT

Website -> http://www.bfp-b.org

Twitter -> https://twitter.com/bfpborg

LinkedIn -> https://www.linkedin.com/company/bfpborg/

Facebook -> http://www.facebook.com/bfpborg

BFP-B email newsletter -> http://eepurl.com/dkzHCX